Car Loan Early Payoff Penalty

Because the banks need to cover their administrative costs and commission already paid out car owners who early redeem their loans are further penalised with a charge of 20 percent of the unpaid interest. Be aware that even if they dont impose pre-payment penalties some loans impose other financial pitfalls for early loan payoff.

Should I Pay Off My Car Loan Early Experian

Should I Pay Off My Car Loan Early Experian

A prepayment penalty is a fee that lenders may charge when you pay off part or all of your loan balance before the loans scheduled maturity date.

Car loan early payoff penalty. A percentage of the remaining loan balance. If you pay off the debt early lenders can potentially charge penalty fees for that prepayment. As your contract shows the finance charge is the cost of credit to you.

Loans like car notes and mortgages are often designed to last for a specific length of time known as the term with the loan balance reaching zero at the end of the term. This discourages buyers from paying the loan off early and allows the lender to collect all the interest. In fact many car loans are structured so that you gain an advantage by paying the loan off early.

Or less frequently the entire remaining balance including both principal and interest. The company only offers one type of auto loan a simple interest loan. In some cases paying off your car loan early can negatively affect your credit score.

Enter your information into the early loan payoff calculator below. So for 100 if you are charged say 5 for 30 days now your loan amount is 105 and you pay off 50 which is way more than your installment fine now your loan amount is 55. Be sure to read the terms of your car loan carefully.

Heres how a simple interest loan works. Some lenders have language in their contracts that actually prevents you from paying down the. The bank will only rebate the borrower 80 percent of the unpaid interest instead of the full sum.

If your loan includes this fee consider whether the financial benefits of paying off your car loan early outweigh the cost of this fee. Nationwide prepayment penalties are allowed in 36 states and the District of Columbia. For example your loan contract might be written as a pre-computed loan meaning you are required to pay the entire amount of the principal and interestregardless of how quickly you pay off the loanproviding no financial savings for early loan payoffs.

Some car loans may come with a prepayment penalty a fee that youd be charged if you paid off your loan early. So say next month you pay another 50 while you are charged a 25. There are no penalties for paying off a Capital One loan early.

Many loans have no penalty for early payment. With most loans if you pay them off sooner than planned you pay less in interest assuming it has no prepayment penalties. Paying off your car loan early can hurt your credit because open positive accounts have a greater impact on your credit score than closed accountsbut there are other factors to consider too.

Penalties for an early loan payoff may be. Typically you wont be charged a prepayment penalty when you put small chunks of extra money toward your loan principal. But that may not be true for your car loan.

A flat fee with or without an expiration date for example 350 for an early payoff within the first half of the loan. By paying an extra amount when you make your payments and if you are never late you will pay less than the total finance charge disclosed on your contract and you will pay your account off sooner. The Bankrate Auto Loan Early Payoff Calculator will help you create the best strategy to shorten the term of your car loan.

If a simple add-on interest auto loan does allow you to pay off the loan early there is often a prepayment penalty that reduces the interest savings or the interest rebate is determined using the. But if you pay off a large part of your balance at once or pay off the entire balance within the first few years even if its due to selling or refinancing your home you may owe the lender a prepayment penalty. Prepayment penalties may be tacked on when you pay off your loan balance or even pay down a large chunk of the principal.

There is no penalty charged for paying off your account sooner.

Does Paying Off A Car Loan Early Hurt Your Credit Experian

Does Paying Off A Car Loan Early Hurt Your Credit Experian

Payoff Auto Loan Early Calculator How Much Extra Should You Pay

Payoff Auto Loan Early Calculator How Much Extra Should You Pay

Should You Pay Off Your Car Loan Early Credit Karma

Should You Pay Off Your Car Loan Early Credit Karma

Should I Pay Off My Car Loan Early Lendingtree

Should I Pay Off My Car Loan Early Lendingtree

Can I Pay Off A Car Loan Early Car Finance Tips Metro Toyota

Can I Pay Off A Car Loan Early Car Finance Tips Metro Toyota

How To Pay Off Auto Loan Early Truliant Fcu

How To Pay Off Auto Loan Early Truliant Fcu

How This Man Paid Off His Car Loan Early And Saved Hundreds Student Loan Hero

How This Man Paid Off His Car Loan Early And Saved Hundreds Student Loan Hero

Prepayment Penalty What Happens If You Pay Off Your Loan Early

Prepayment Penalty What Happens If You Pay Off Your Loan Early

4 Proven Ways To Pay Off Your Car Loan Faster Rategenius

4 Proven Ways To Pay Off Your Car Loan Faster Rategenius

Understanding Extra Payments To Your Amount Financed Ally

Understanding Extra Payments To Your Amount Financed Ally

Drawbacks And Considerations Of Paying Off Your Car Loan Ear

Drawbacks And Considerations Of Paying Off Your Car Loan Ear

How Car Loan Principal Works Rategenius

How Car Loan Principal Works Rategenius

6 Things To Do After You Pay Off Your Car Loan Part Time Money

6 Things To Do After You Pay Off Your Car Loan Part Time Money

/salesman-handing-woman-car-keys-in-automobile-showroom-108359714-5bdc3a7ec9e77c0051406371.jpg) How To Get A Car Loan Payoff Quote

How To Get A Car Loan Payoff Quote

Should I Pay Off My Car Loan Early Here S How To Decide Student Loan Hero

Should I Pay Off My Car Loan Early Here S How To Decide Student Loan Hero

Paying Off Your Loans Early What You Need To Know

Paying Off Your Loans Early What You Need To Know

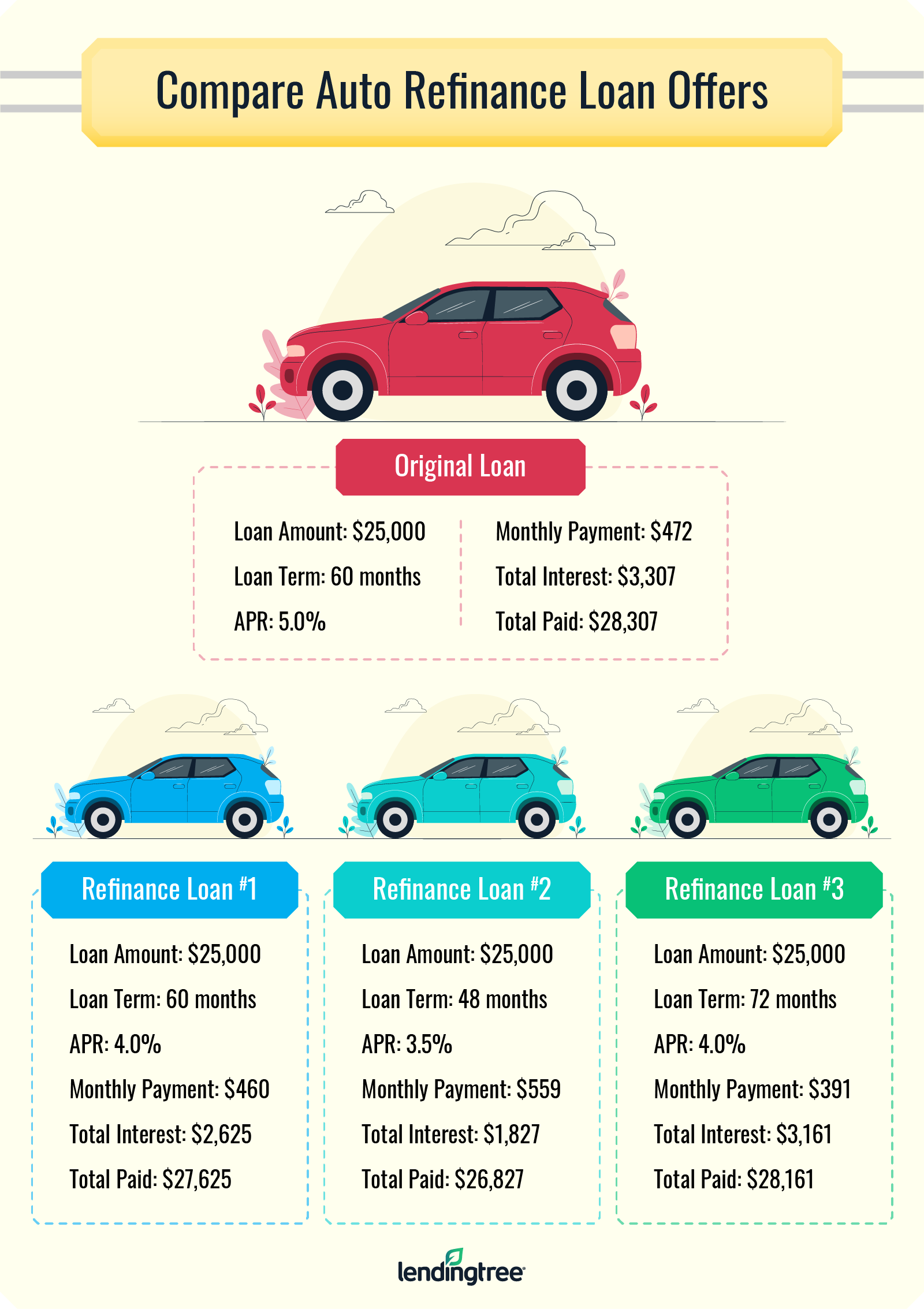

How To Refinance A Car Loan In 6 Steps Lendingtree

How To Refinance A Car Loan In 6 Steps Lendingtree

Post a Comment for "Car Loan Early Payoff Penalty"